PMG tiedotti viikko sitten hankkineensa 75% osuuden brasilialaisesta Alvopetro S.A:sta. Hankinnan kautta PMG saa osuudet 40,000 eekkeriin PNG-oikeuksia Reconcavo Basinissa. Reconcavosta on tuotettu 1.5 miljardia tynnöriä öljyä alkaen 1930-luvulta, mutta alueelta ei ole tehty merkittäviä tavanomaisia löytöjä viime vuosikymmeninä, lukuunottamatta Petrobrasin noin 15 miljoonan BOE:n osumaa basinin pohjoisrajalla.

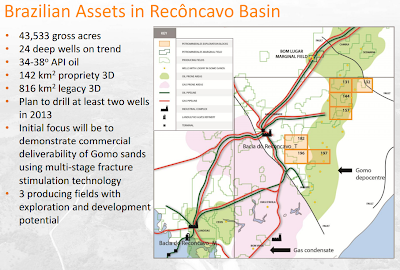

PMG:n joulukuun presentaatiosta:

Gran Tierra(GTE) on toiminut Reconcavossa vajaat pari vuotta. Yhtiön tuotanto alueelta nousi tämän vuoden lokakuun lopulla uuteen ennätykseen(kesäkuussa100 boeta->lokakuun 18. päivä 850 boeta) kolmen uuden kaivon kaivon tuotannon käynnistyttyä. Kiavot tuottavat ilmeisesti tavanomaisesta poolista, mutta GTE on piakoin testaamassa horisontaaleja tiukkaan hiekkakivimuodostelmaan, mahdollisesti samaan yllä mainittuun Gomo-muodostelmaan(yllä linkatun presentaation sivulta 25 löytyy Gomon parametreja verrattuna valittuihin P-Amerikan tiukkoihin muodostelmiin).

Alemmasta kartasat(napattu Brookwater Venuresin presentaatiosta) näkyy, että PMG uudet pläntit ovat melkein hajuetäisyydellä(itä ja eteläpuolella) GTE:n blokeista. GTE osti muuten oikeutensa Recâvossa Alvorada Petroleo-nimiseltä yhtiöltä, liekä tällä mitään yhteyttä Alvopetroon.

Tavanomaisien löytöjen(ja siten nopeiden merkittävien tuotannon lisäyksien) todennäköisyys PMG:n uusilta eekkereiltä Brasiliasta on varsin vähäinen, mutta pidemmän aikavälin resource play-potentiaalia näyttäisi olevan. GTE:ltä pitäisi tulla uutisia Gomon horisontaalista potentiaalista 6 kk:n sisällä.